We are sure you have heard of the famous phrase, “Buy Low, Sell High”, right? Trying to time the housing market so you sell at the top and can still get into another home so it seems like a bargain is harder than it seems. But there are times when you look at leading indicators to give you a clue and those clues are showing up right now. If you have been seriously considering the idea of making your big move or downsizing and buying a retirement/income home in West Hawaii, this may be the right time. Here are five clues to a changing market.

We are sure you have heard of the famous phrase, “Buy Low, Sell High”, right? Trying to time the housing market so you sell at the top and can still get into another home so it seems like a bargain is harder than it seems. But there are times when you look at leading indicators to give you a clue and those clues are showing up right now. If you have been seriously considering the idea of making your big move or downsizing and buying a retirement/income home in West Hawaii, this may be the right time. Here are five clues to a changing market.

- According to a recent article published in the New York Times, nationwide, sales of previously owned homes fell 1.5 percent in august from a year earlier, according to the National Association of Realtors. Residential building permits were down 5.5 percent over the past year, according to the Department of Commerce. Many economists say the housing market may have turned into a drag on the gross domestic product.

New York Times Article: https://www.nytimes.com/2018/09/29/business/economy/home-prices-housing-market-slowdown.html - NAR Chief Economist Lawrence Yun says several consecutive years of strong home price growth are enticing homeowners to consider selling. “Though the vast majority of consumers believe home prices will continue to increase or hold steady, they understand the days of easy, fast gains could be coming to an end. Therefore, more are indicating that it is a good time to sell, which is a healthy shift in the market.”

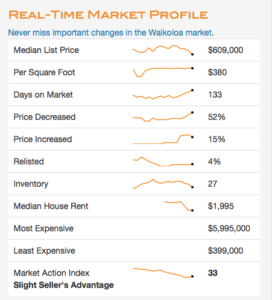

- According to a real-time real estate data company, Altos Research, the housing market across the country seemed to hit its peak in March and plateaued through the summer and now anxious sellers are starting to lower their prices. In the SF Bay Area, an average of 25% of the single family home listings had dropped their prices. Locally, in Waikoloa, 50% have lowered their listing prices as the market is cooling ahead of the normal “Snowbird Season” during the holidays and January.

- If you are in a hot housing market, salaries are not keeping pace with the rising prices of homes, which is causing a market pull back in cities across the country. According to the NYT article, after years of breakneck growth, home prices are now rising more slowly in many metro areas. But prices are still rising faster than wages, and few experts expect them to fall outright.

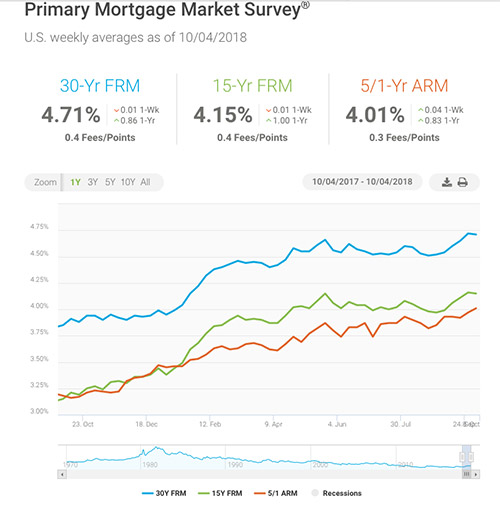

- Rising interest rates have also made buying homes more expensive. Mortgage interest rates have been on the rise and are now over three-quarters of a percentage point higher than they were at

the beginning of the year. According to Freddie Mac’s latest Primary Mortgage Market Survey, rates climbed to 4.72% for a 30-year fixed rate mortgage last week. The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Rising rates, coupled with high housing prices and flat wage growth are the clues you can look at right now to know the market is changing. You can get ahead of the market by pricing your home competitively now and take the gains you may have enjoyed during the past several years to buy a home here in Hawaii, where the market is still strong due to demand, but negotiations can take place with motivated sellers.

If you would like to learn more about how the market is doing in the neighborhoods you may be interested in, contact LUVA Real Estate today. We can also put you in touch with one of our trusted mortgage brokers for their expertise or consult with your financial advisor.